UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934

Filed by the registrantx

Filed by a party other than the registrant¨

Check the appropriate box:

¨ Preliminary Proxy Statement | ¨ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e) (2)) | |

x Definitive Proxy Statement | ||

¨ Definitive Additional Materials | ||

¨ Soliciting Material Pursuant to Section 240.14a-12 |

General Dynamics Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of filing fee (check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Notice of Annual Meeting

and

Proxy Statement

2009

March 20, 2009

Dear Fellow Shareholder:

You are invited to our Annual Meeting of Shareholders on Wednesday, May 6, 2009, at 9:00 a.m. local time. The meeting will be held at our headquarters located at 2941 Fairview Park Drive, Falls Church, Virginia. The principal items of business will be the election of directors, approval of the General Dynamics 2009 Equity Compensation Plan and the 2009 General Dynamics United Kingdom Share Save Plan, and an advisory vote on the selection of the company’s independent auditors. Shareholders may raise other matters, as described in the accompanying Proxy Statement. Enclosed with the Proxy Statement are your proxy card, return envelope and the 2008 Annual Report.

Your vote is important. We encourage you to consider carefully the matters before us. To ensure that your shares are represented at the meeting, you may complete, sign and return the proxy card, or you may use the telephone or Internet voting systems.

Please let us know if you plan to attend so that we can send you an admission card.

Sincerely yours,

Nicholas D. Chabraja

Chairman of the Board of Directors and Chief Executive Officer

2941 Fairview Park Drive, Suite 100

Falls Church, Virginia 22042-4513

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to Be Held on May 6, 2009

The Proxy Statement and 2008 Annual Report are available atwww.generaldynamics.com/2009proxy.

The Annual Meeting of Shareholders of General Dynamics Corporation, a Delaware corporation, will be held on Wednesday, May 6, 2009, at 9:00 a.m. local time at the General Dynamics Corporation headquarters located at 2941 Fairview Park Drive, Falls Church, Virginia. Proposals to be considered at the Annual Meeting include:

The Board of Directors unanimously recommends that you vote FOR proposals 1, 2, 3 and 4.

The Board of Directors unanimously recommends that you vote AGAINST proposals 5 and 6.

The Board of Directors set the close of business on March 9, 2009, as the record date for determining the shareholders entitled to receive notice of, and to vote at, the Annual Meeting. It is important that your shares be represented and voted at the meeting. Please complete, sign and return your proxy card, or use the telephone or Internet voting systems.

We are enclosing a copy of the 2008 Annual Report with this Notice and Proxy Statement.

By Order of the Board of Directors,

David A. Savner

Secretary

Falls Church, Virginia

March 20, 2009

Proxy Statement

2011

March 20, 200918, 2011

Dear Fellow Shareholder:

You are invited to our Annual Meeting of Shareholders on Wednesday, May 4, 2011, at 9:00 a.m. local time. The meeting will be held at our headquarters located at 2941 Fairview Park Drive, Falls Church, Virginia. The principal items of business will be the election of directors; an advisory vote on the selection of the company’s independent auditors; an advisory vote on executive compensation; and an advisory vote on the frequency of future advisory votes on executive compensation. Shareholders may raise other matters, as described in the accompanying Proxy Statement.

We have elected to provide the proxy materials for our 2011 annual meeting to most of our shareholders via the Internet, as permitted by the rules of the Securities and Exchange Commission. We believe this method of providing proxy materials will expedite receipt of proxy materials by many of our shareholders and lower the costs of our annual meeting. Additional information regarding proxy materials distribution is provided on page 2 of our proxy statement.

Your vote is important. We encourage you to consider carefully the matters before us.

Sincerely yours,

Jay L. Johnson

Chairman and Chief Executive Officer

2941 Fairview Park Drive, Suite 100

Falls Church, Virginia 22042-4513

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to Be Held on May 4, 2011

The Proxy Statement and 2010 Annual Report are available atwww.generaldynamics.com/2011proxy.

The Annual Meeting of Shareholders of General Dynamics Corporation, a Delaware corporation, will be held on Wednesday, May 4, 2011, at 9:00 a.m. local time at the General Dynamics Corporation headquarters located at 2941 Fairview Park Drive, Falls Church, Virginia. Proposals to be considered at the Annual Meeting include:

| 1. | the election of 11 directors; |

| 2. | an advisory vote on the selection of KPMG LLP as the company’s independent auditors for 2011; |

| 3. | an advisory vote on executive compensation; |

| 4. | an advisory vote on the frequency of future advisory votes on executive compensation; |

| 5. | a shareholder proposal regarding a human rights policy, provided it is presented properly at the meeting; |

| 6. | a shareholder proposal regarding special shareholder meetings, provided it is presented properly at the meeting; and |

| 7. | the transaction of all other business that properly comes before the meeting or any adjournment or postponement of the meeting. |

The Board of Directors unanimously recommends that you vote FOR proposals 1, 2 and 3.

The Board of Directors unanimously recommends for proposal 4 that you vote to hold future executive compensation advisory votes EVERY THREE YEARS.

The Board of Directors unanimously recommends that you vote AGAINST proposals 5 and 6.

The Board of Directors set the close of business on March 7, 2011, as the record date for determining the shareholders entitled to receive notice of, and to vote at, the Annual Meeting. It is important that your shares be represented and voted at the meeting. Please complete, sign and return a proxy card, or use the telephone or Internet voting systems.

A copy of the 2010 Annual Report is included with this Notice and Proxy Statement and is available on the website listed above.

By Order of the Board of Directors,

Gregory S. Gallopoulos

Secretary

Falls Church, Virginia

March 18, 2011

Proxy Statement

March 18, 2011

The Board of Directors of General Dynamics Corporation is soliciting your proxy for the Annual Meeting of Shareholders to be held on May 6, 2009,4, 2011, at 9:00 a.m. local time, or at any adjournment or postponement of the meeting. This Proxy Statement, and the accompanying Notice of Annual Meeting of Shareholders and proxy card, are being forwardeddistributed on or about March 20, 2009,18, 2011, to holders of General Dynamics common stock, par value $1.00 per share (Common Stock). General Dynamics is a Delaware corporation.

| 2 | ||||

Election of the Board of Directors of the Company (Proposal 1) | 6 | |||

| 11 | ||||

| 23 | ||||

| 35 | ||||

| 50 | ||||

| 51 | ||||

| 52 | ||||

| 53 | ||||

| 53 | ||||

| 54 | ||||

| ||||

| ||||

| 55 | ||||

| 57 | ||||

Advisory Vote on the Frequency of Future Executive Compensation Advisory Votes (Proposal 4) | 58 | |||

Shareholder Proposal – | 59 | |||

Shareholder Proposal – | 62 | |||

| 64 | ||||

| 64 | ||||

| 64 | ||||

Shareholder Proposals for | 64 | |||

| 64 | ||||

| ||||

|

All shareholders of record at the close of business on March 9, 2009,7, 2011, are entitled to vote their shares of Common Stock at the Annual Meeting. On the record date, General Dynamics had 385,420,804373,358,310 shares of Common Stock issued and outstanding.

Annual Meeting Attendance

Attending the Annual Meeting. All shareholders are welcome to attend the Annual Meeting. You will need an admission card or proof of ownership of Common Stock and personal photo identification for admission. If you hold shares directly in your name as a shareholder of record, you may obtain an admission card through the telephone or Internet voting systems or by marking the appropriate box on youra proxy card. If your shares are held by a bank, broker or other holder of record (commonly referred to as registered in “street name”), you are considered a beneficial owner of those shares rather than a shareholder of record. In that case, you must present at the Annual Meeting proof of ownership of Common Stock, such as a bank or brokerage statement.

Quorum for the Transaction of Business.A quorum is the presence, in person or by proxy, of holders of a majority of the issued and outstanding shares of Common Stock as of the record date. If you submit a properly completed proxy in accordance with one of the voting procedures described below or appear at the Annual Meeting to vote in person, your shares of Common Stock will be considered present. For purposes of determining whether a quorum exists, abstentions and broker non-votes (as described below) will be counted as present. Once a quorum is present, voting on specific proposals may proceed. In the absence of a quorum, the Annual Meeting may be adjourned.

Proxy Materials Distribution

As permitted by the rules of the Securities and Exchange Commission (SEC), we are providing the proxy materials for our 2011 Annual Meeting via the Internet to most of our shareholders. For some shareholders, such as participants in our 401(k) plans, we are required to deliver proxy materials in hard copy. Nevertheless, we believe the use of the Internet will expedite receipt of the 2011 proxy materials by many of our shareholders and lower the costs of our Annual Meeting. On March 18, we initiated delivery of proxy materials to our shareholders of record one of two ways: (1) a notice containing instructions on how to access proxy materials via the Internet or (2) a printed copy of those materials. If you received a notice in lieu of a printed copy of the proxy materials, you will not automatically receive a printed copy of the proxy materials in the mail. Instead, the notice provides instructions on how to access the proxy materials on the Internet and how to vote online or by telephone. If you received such a notice, but would also like to receive a printed copy of the proxy materials, the notice includes instructions on how you may request a printed copy.

Voting

Voting Procedures.You must be a shareholder of record on the record date to vote your shares.shares at the Annual Meeting. Each shareholder of record is entitled to one vote on all matters presented at the Annual Meeting for each share of Common Stock held. You are considered a shareholder of record if your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A. (Computershare), as of the record date. If you are a shareholder of record, Computershare provides proxy materials to you on our behalf. If your shares are registered in different names or held in more than one account, you may receive more than one proxy card or set of voting

instructions. In that case, you will need to vote separately for each set of shares in accordance with the voting procedures outlined below.

Shareholders of record may cast their vote by:

| (1) | signing and dating each proxy card received and returning each card using the prepaid envelope; |

| (2) | calling 1-800-652-VOTE (1-800-652-8683), or, outside the United States, Canada and Puerto Rico, calling 1-781-575-2300, and following the instructions provided on the phone line; |

| (3) | accessing |

| (4) | attending the Annual Meeting and voting by ballot. |

The telephone and Internet voting systems are available 24 hours a day. They will close at 11:59 p.m. Eastern Time on May 5, 2009.3, 2011.Please note that the voting deadline differs for participants in our 401(k) plans, as described below. All shares represented by properly executed, completed and unrevoked proxies that are received on time will be voted at the Annual Meeting in accordance with the specifications made in the proxy card. If you return a proxy card but do not specifically direct the voting of shares, your proxy will be voted as follows:

| (1) | FOR the election of directors as described in this Proxy Statement; |

| (2) | FOR the |

| (3) | FOR the approval, on an advisory basis, of the compensation of the named executive officers; |

| (4) | on an advisory basis, in favor of holding future executive compensation advisory votes EVERY THREE YEARS; |

| (5) | AGAINST the |

| (6) | in accordance with the judgment of the proxy holders for other matters that may properly come before the Annual Meeting. |

If your shares are held by a bank, broker or other holder of record, you are athe beneficial owner of those shares rather than athe shareholder of record. If you are a beneficial owner, your bank, broker or other holder of record will forward the proxy materials to you. As a beneficial owner, you have the right to direct your bank, broker or other holderthe voting of record how to vote your shares by following the voting instructions provided with these proxy materials. Please refer to the proxy materials forwarded by your bank, broker or other holder of record to see if the voting options described above are available to you.

The Northern Trust Company (Northern Trust) is the holder of record of the shares of Common Stock held in our 401(k) plans – the General Dynamics Corporation Savings and Stock Investment Plans and the General Dynamics Corporation Savings and Stock Investment Plan for Represented Employees. If you are a participant in one of these plans, you are the beneficial owner of the shares of Common Stock credited to your plan account. As beneficial owner and named fiduciary, you have the right to instruct Northern Trust, as plan trustee, how to vote your shares. In the absence of timely voting instructions, Northern Trust has the right to vote shares at its discretion.

Computershare provides proxy materials to participants in these plans on behalf of Northern Trust. If you are a plan participant and a shareholder of record, Computershare may combine the shares registered directly in your name and the shares credited to your 401(k) plan account onto one proxy card. If Computershare does not combine your shares, you will receive more than one set of proxy

materials. In that case, you will need to submit a vote for each set of shares. The vote you submit via proxy card or the telephone or Internet voting systems will serve as your voting instructions to Northern Trust.To allow sufficient time for Northern Trust to vote your 401(k) plan shares, your vote, or any re-vote as described below, must be received by 9:009 a.m. Eastern Time on May 4, 2009.2, 2011.

Revoking a Proxy. A shareholder of record may revoke a proxy at any time before it is voted at the Annual Meeting by:

| (1) | sending written notice of revocation to our Corporate Secretary; |

| (2) | submitting another proxy card that is dated later than the original proxy card; |

| (3) | re-voting by using the telephone or Internet voting systems; or |

| (4) | attending the Annual Meeting and voting by |

Our Corporate Secretary must receive notice of revocation, or a subsequent proxy card, before the vote at the Annual Meeting for a revocation to be valid. Except as described above for participants in our 401(k) plans, a re-vote by the telephone or Internet voting systems must occur before 11:59 p.m. Eastern Time on May 5, 2009.3, 2011. If you are a beneficial owner, you must revoke your proxy through the appropriate bank, broker or other holder of record.

Vote Required

Proposal 1 – Election of the Board of Directors of the Company. Directors will be elected by a majority of the votes cast and entitled to vote at the Annual Meeting. A “majority of the votes cast” means that the number of votes cast “for” a director’s election exceeds the number of votes cast “against” that director’s election. You may vote for, vote against or abstain from voting for any or all nominees. An abstention will not be counted as a vote cast “for” or “against” a director’s election.

Proposals 2 and 3 – Approval of the General Dynamics 2009 Equity Compensation Plan and the 2009 General Dynamics United Kingdom Share Save Plan. These proposals require an affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote at the Annual Meeting to be approved, provided that the total vote cast (which includes for and against votes and abstentions, but excludes broker non-votes) on these proposals must represent over 50 percent of the issued and outstanding shares of Common Stock. You may vote for, vote against or abstain from voting on these matters. Abstentions will have the effect of a vote against these proposals.

Proposal 4 – Selection of Independent Auditors. This proposal requires an affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote at the Annual Meeting to be approved. You may vote for, vote against or abstain from voting on this matter. Abstentions will have the effect of a vote against this proposal.

Proposals 5 and 6 – Shareholder Proposals. Proposals 5 and 6 each require an affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote on the proposal to be approved. You may vote for, vote against or abstain from voting on these matters. Abstentions on either of these proposals will have the effect of a vote against the proposal.

Broker Non-Vote. A broker non-vote occurs when a bank, broker or other holder of record holding shares for a beneficial owner does not vote on a particular proposal because that holder does not have discretionary voting power for the proposal and has not received voting instructions from the beneficial owner. Banks, brokers and other holders of record have discretionary authority to vote shares without instructions from beneficial owners only on matters considered “routine” by the New York Stock Exchange, such as the election of directors and the advisory vote on the selection of the independent auditors. On non-routine matters, such as approvalthe election of equitydirectors, executive compensation plansmatters and the shareholder proposals, these banks, brokers and other holders of record do not have discretion to vote uninstructed shares without instructions from beneficial owners and thus are not “entitled to vote” on such proposals. The result isproposals, resulting in a broker non-vote for those shares.We encourage all shareholders that hold shares through a bank, broker or other holder of record to provide voting instructions to such parties to ensure that their shares are voted at the Annual Meeting.

Proposal 1 – Election of the Board of Directors of the Company.Directors will be elected by a majority of the votes cast and entitled to vote at the Annual Meeting. A “majority of the votes cast” means that the number of votes cast “for” a director’s election exceeds the number of votes cast “against” that director’s election. You may vote for, vote against or abstain from voting for any or all nominees. Abstentions and broker non-votes will not be counted as a vote cast “for” or “against” a director’s election.

Proposal 2 – Selection of Independent Auditors.This proposal requires an affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote at the Annual Meeting to be approved. You may vote for, vote against or abstain from voting on this matter. Abstentions will have the effect of a vote against this proposal.

Proposal 3 – Advisory Vote on Executive Compensation. This proposal requires an affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote at the Annual Meeting to be approved. You may vote for, vote against or abstain from voting on this matter. Abstentions will have the effect of a vote against this proposal.

Proposal 4 – Advisory Vote on the Frequency of Future Executive Compensation Advisory Votes. For this proposal, you may choose to express a preference for holding future advisory votes on executive compensation every year, every two years or every three years. For any particular frequency to be approved, it must receive an affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote at the Annual Meeting. You may choose instead to abstain from voting on this matter. Abstentions will have the effect of a vote against each choice.

Proposals 5 and 6 – Shareholder Proposals. Proposals 5 and 6 each require an affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote on the proposal to be approved. You may vote for, vote against or abstain from voting on these matters. Abstentions will have the effect of a vote against the proposals.

Voting Tabulation. Representatives of IVS Associates Inc.American Election Services, LLC, will tabulate the vote at the Annual Meeting.

Proxy Solicitation. The Board of Directors is soliciting proxies from shareholders. Directors, officers and other employees of General Dynamics may solicit proxies from our shareholders by mail, e-mail, telephone, facsimile or in person. In addition, Innisfree M&A Incorporated (Innisfree), 501 Madison Avenue, New York, New York, is soliciting brokerage firms, dealers, banks, voting trustees and their nominees.

We will pay Innisfree approximately $15,000 for soliciting proxies for the Annual Meeting and will reimburse brokerage firms, dealers, banks, voting trustees, their nominees and other record holders for their out-of-pocket expenses in forwarding proxy materials to the beneficial owners of Common Stock. We will not provide compensation, other than their usual compensation, to our directors, officers and other employees who solicit proxies.

Retiring from the Board of Directors

Pursuant to the director retirement policy contained in our Bylaws and Corporate Governance Guidelines, Charles H. Goodman and Carl E. Mundy, Jr., will not stand for re-election at the Annual Meeting. General Dynamics and the Board appreciate their many years of dedicated service and valuable counsel as members of the Board.

|

|

Election of the Board of Directors of the Company

(Proposal 1)

This year, 11 nominees are standing for election to the Board of Directors. Each nominee elected as a director will hold office until:

| (1) | the next annual meeting and his or her successor is elected and qualified, or |

| (2) | his or her earlier death, removal or resignation. |

In the event that any nominee withdraws or for any reason is unable to serve as a director, your proxy will be voted for any remaining nominees (except as otherwise indicated in your proxy) and for any replacement nominee designated by the Nominating and Corporate Governance Committee of the Board of Directors.

| Mary T. Barra,49, director since 2011. Senior Vice President, Global Product Development, of General Motors Company since February 2011. Vice President, Global Human Resources, from 2009 to January 2011. Vice President, Global Manufacturing Engineering, from 2008 to 2009. Executive Director, Vehicle Manufacturing Engineering, from 2004 to 2008. Appointed to the Board in March 2011, Ms. Barra was first identified by a third-party search firm and was recommended as a director nominee by the Nominating and Corporate Governance Committee. | |

Ms. Barra’s business and educational background, including a bachelors degree in electrical engineering and a masters degree in business administration, enable her to provide valuable strategic, operational and business advice to the company. Ms. Barra’s current position with General Motors as senior vice president, global product development, and her former positions as vice president, global human resources, and vice president, global manufacturing engineering, position her well to advise our businesses on a broad range of matters in the areas of human resources, engineering, manufacturing, and research and development. Her strong and diversified business background provides her with a deep understanding of the challenges facing large public companies with complex global operations.

| Nicholas D. Chabraja, Chairman | |

Mr. Chabraja’s 15 years of service as a senior executive officer and 12-year tenure as chairman and chief executive officer of our company make him an experienced and trusted advisor. He has in-depth knowledge of all aspects of General Dynamics and a deep understanding and appreciation of our customers, business operations and approach to risk management. His service at General Dynamics combined with his service on other public company boards provides him with a valuable perspective on governance and management matters that face large public companies.

| James S. Crown, Lead Director since May 2010. President of Henry Crown and Company (diversified investments) since 2002. Vice President of Henry Crown and Company from 1985 to 2002. | |

As the longest-serving member of our board and a significant shareholder, Mr. Crown has an abundance of knowledge regarding General Dynamics and its history. As president of Henry Crown and Company, a private investment firm with diversified interests, Mr. Crown has broad experience in general business management and capital deployment strategies. His many years of service as a director of our company and two other large public companies have provided him with a deep understanding of the roles and responsibilities of a board of a large public company.

| William P. Fricks, Chairman and Chief Executive Officer of Newport News Shipbuilding Inc. from 1997 to 2001. Chief Executive Officer and President of Newport News Shipbuilding Inc. from 1995 to 1996. | |

Mr. Fricks’ prior senior executive positions at Newport News Shipbuilding Inc., including chairman and chief executive officer, president and chief executive officer, vice president-finance, controller and treasurer, give him critical knowledge of the management, financial and operational requirements of a large company and a keen understanding of our key customers. In these positions, Mr. Fricks gained extensive experience in dealing with accounting principles and financial reporting, evaluating financial results and the financial reporting process of a large company. Based on this experience, the Board has determined that Mr. Fricks is an Audit Committee Financial Expert.

| Jay L. Johnson, Chairman and Chief Executive Officer since May 2010. President and Chief Executive Officer from July 2009 to May 2010. Vice Chairman | |

Prior to joining General Dynamics in September 2008, Mr. Johnson served as both chief executive officer of large gas and electric utility businesses and as an Admiral in the U.S. Navy. He served as a director of General Dynamics for six years before becoming an executive officer of the company. Mr. Johnson rose through the ranks of the U.S. Navy to become Chief of Naval Operations and a member of the Joint Chiefs of Staff. Mr. Johnson’s superior business acumen, knowledge of all aspects of the company’s business and history, and prior military experience position him well to serve as our chairman and chief executive officer.

| George A. Joulwan, Retired General, U.S. Army. Supreme Allied Commander, Europe, and Commander-in-Chief, European Command, from 1993 to 1997. Commander-in-Chief, Southern Command, from 1990 to 1993. President of One Team, Inc., (consulting) since 1999. Adjunct Professor at the National Defense University from 2001 to 2005. Olin Professor, National Security, at the U.S. Military Academy at West Point from 1998 to 2000. | |

Mr. Joulwan had a distinguished career in the U.S. Army prior to joining our Board in 1998. As a General, Mr. Joulwan served as Commander-in-Chief of the Southern Command and the European Command and as the 11thSupreme Allied Commander, Europe. Mr. Joulwan’s unique perspective on U.S. and foreign military strategy and operations, including NATO operations, provides him with valuable insight into international defense markets and the global defense industry. Mr. Joulwan’s demonstrated leadership and management skills make him a valuable strategic advisor to our aerospace and defense businesses.

| Paul G. Kaminski, Under Secretary of U.S. Department of Defense for Acquisition and Technology from 1994 to 1997. Chairman and Chief Executive Officer of Technovation, Inc., (consulting) since 1997. Senior Partner of Global Technology Partners, LLC, (consulting) | |

Dr. Kaminski’s prior service as the Under Secretary of Defense for Acquisition and Technology provides him with valuable insight into research and development, procurement, acquisition reform and logistics at the U.S. Department of Defense. In addition, Dr. Kaminski’s education and business background in advanced technology, including dual master’s degrees in aeronautics-astronautics and electrical engineering and a doctorate in aeronautics and astronautics, enable him to provide valuable strategic and business advice to our aerospace and defense businesses.

| John M. Keane, Retired General, U.S. Army. Vice Chief of Staff of the Army from 1999 to 2003. Senior Partner of SCP Partners (private equity) since 2009. Managing Director of Keane Advisors, LLC, (private equity) | |

Prior to retiring from the U.S. Army at the rank of General, Mr. Keane served as Vice Chief of Staff of the Army. As a senior officer, Mr. Keane managed significant operating budgets and addressed complex operational and strategic issues. Mr. Keane’s astute appreciation for the complexities of the U.S. military and the defense industry combined with his demonstrated leadership and management skills make him a valuable strategic advisor to our aerospace and defense businesses. Mr. Keane also has gained a strong understanding of public company governance and operations through his service on three public company boards.

|

|

| Lester L. Lyles, Retired General, U.S. Air Force. Commander, Air Force Materiel Command from 2000 to 2003. Vice Chief of Staff of the Air Force from 1999 to 2000. | ||

|

|

| William A. Osborn, 63, director since 2009. Chairman of Northern Trust Corporation (multibank holding company) from October 1995 to November 2009. Chief Executive Officer of Northern Trust Corporation from 1995 to 2007 and President of Northern Trust Corporation and The Northern Trust Company (banking services) from 2003 to 2006. Mr. Osborn currently serves as a director of Abbott Laboratories, Caterpillar, Inc., and Tribune Company, a public company until December 2007. He served as a director of Nicor Inc. and Northern Trust Corporation within the past five years. | |

Mr. Osborn’s prior service as a senior executive of Northern Trust Corporation, including as chairman and chief executive officer, president and chief operating officer, provides him with extensive knowledge of the complex financial, operational and governance issues of a large public company. He brings to our board a well-developed awareness of financial strategy and asset management and a strong understanding of public company governance. The Board has determined that Mr. Osborn’s extensive experience with accounting principles, financial reporting and evaluation of financial results qualifies him as an Audit Committee Financial Expert.

| Robert Walmsley, Retired Vice Admiral, Royal Navy. Chief of Defence Procurement for the United Kingdom Ministry of Defence from 1996 to 2003. Senior Advisor to Morgan Stanley & Co. Limited (investment banking) since February 2004. | |

Our Bylaws specify thatMr. Walmsley’s prior service as Chief of Defence Procurement for the numberUnited Kingdom Ministry of directors will be not less than five nor more than 15,Defence gives him acute comprehension of international defense matters. Moreover, his service as determined bya Vice Admiral in the Board. The sizeRoyal Navy and his appointments as Controller, Chairman of the Board currently is setNaval Nuclear Technical Safety Panel and Director General, Submarines, provide him with an important perspective on our aerospace and defense businesses. Mr. Walmsley’s service as a public company director in the United States and the United Kingdom positions him well to understand complex operational and governance matters at 13 members, but will be reduced to 11 members upon the retirement of Charles H. Goodman and Carl E. Mundy, Jr., from the Board.a large public company.

Your Board of Directors unanimously recommends a vote FOR all the director nominees listed above.

Board of Directors

The Board of Directors oversees General Dynamics’ business and affairs pursuant to the General Corporation Law of the State of Delaware and our Certificate of Incorporation and Bylaws. The Board is the ultimate decision-making body, except on matters reserved for the shareholders.

Corporate Governance Guidelines

Our Board of Directors believes that a commitment to good corporate governance enhances shareholder value. To that end, on the recommendation of the Nominating and Corporate Governance Committee, the Board has adopted governance policies and procedures to ensure effective governance of both the Board and the company. The policies and procedures are stated in the General Dynamics Corporate Governance Guidelines, available on our website atwww.generaldynamics.com, under the “Investor Relations – Corporate Governance” captions, or in print upon request. The Board benchmarksregularly reviews these guidelines against theand updates them periodically in response to changing regulatory requirements and evolving best practices of other public companies and considers suggestions made by various groups knowledgeable about corporate governance. Further, the Board regularly evaluates these guidelines to ensure compliance with the rules and regulations of the Securities and Exchange Commission and the New York Stock Exchange. The Board may modify existing policies or adopt new policies to comply with new legislation and with rule changes made by the Securities and Exchange Commission or the New York Stock Exchange.practices.

Codes of Ethics

Since the inception of a formal ethics program in 1985, our Board of Directors and management have devoted significant time and resources to maintaining an active and robust ethics program. Since 1985, we have had a Standards of Business Ethics and Conduct Handbook that applies to all employees. This handbook, known as the “Blue Book,” has been updated and improved as we have grown and changed over the years. Our ethics program also includes a 24-hour ethics hotline,helpline, which employees can call to communicate any business ethics-related concerns, and periodic training on ethics and compliance topics for all employees.

We also have also adopted ethics codes specifically applicable to our financial professionals and our Board of Directors. The Code of Ethics for Financial Professionals, which supplements the Blue Book, applies to our chief executive officer, chief financial officer, controller and any person performing similar financial functions. In addition, there is a Code of Conduct for Members of the Board of Directors that embodies our Board’s commitment to manage our business in accordance with the highest standards of ethical conduct.

Copies of the Standards of Business Ethics and Conduct Handbook, Code of Ethics and Code of Conduct are available on our website atwww.generaldynamics.com, under the “Investor Relations – Corporate Governance” captions, or in print upon request. We will disclose on our website any amendments to or waivers from the Standards of Business Ethics and Conduct, Code of Ethics or Code of Conduct on behalf of any of our executive officers, financial professionals or directors.

Related-PersonRelated Person Transactions Policy

Our Board of Directors has adopted a written policy on the review and approval of related-personrelated person transactions. Related persons covered by the policy are:

| (1) | executive officers, directors and director nominees; |

| (2) | any person who is known to be a beneficial owner of more than 5 percent of our voting securities; |

| (3) | any immediate family member of any of the foregoing persons; or |

| (4) | any entity in which any of the foregoing persons has or will have a direct or indirect material interest. |

A related-personrelated person transaction is defined by this policy as a transaction, arrangement or relationship (or any series of similar transactions, arrangements or relationships) in which: (1) General Dynamics will be a participant; (2) the amount involved exceeds $120,000; and (3) any related person will have a direct or indirect material interest. The following interests and transactions are not subject to the policy:

| (1) | director compensation that has been approved by the Board; |

| (2) | a transaction where the rates or charges are determined by competitive bid; or |

| (3) | a compensatory arrangement solely related to employment with General Dynamics (or a subsidiary) that has been approved by the Compensation Committee, or recommended by the Compensation Committee to the Board. |

The Nominating and Corporate Governance Committee is responsible for reviewing, approving and, where applicable, ratifying related person transactions. If a member of the committee has an interest in a related-personrelated person transaction, then he or she will not be part of the review process.

In considering the appropriate action to be taken regarding a related-personrelated person transaction, the committee or the Board (as the case may be) will consider the best interests of General Dynamics and whether the transaction is fair to the company, is on terms that would be obtainable in an arms-length transaction and serves a compelling business reason, and any other factors it deems relevant. As a condition to approving or ratifying any related-personrelated person transaction, the committee or the Board may impose whatever conditions and standards it deems appropriate, including periodic monitoring of ongoing transactions.

The following transactions in 2008transaction with a related persons wereperson was determined to pose no actual conflict of interest and werewas approved by the committee pursuant to our related-personrelated person transactions policy:

During the second quarter of 2008, Reyes Holdings L.L.C.,In January 2010, Nicholas D. Chabraja entered an agreement to purchase a company of which J. Christopher Reyes is chairman, completed the purchase of anmid-sized pre-owned aircraft from Gulfstream Aerospace Corporation, a subsidiary of General Dynamics, for a price of approximately $33 million.$8,500,000. The sales agreement with Gulfstreampurchase was entered intocompleted in July 2006.the first quarter of 2010. The terms and conditions of the sales agreement were negotiated in an arms-length transaction and represent standard terms and conditions.

Since 2005, we have retained the Podesta Group,conditions for a consulting firm, to provide consulting services. From December 2007 until February 2009, David Morrison, the husband of Phebe N. Novakovic, an executive officer of General Dynamics, was an employee of the Podesta Group. We paid the firm approximately $367,000 for services provided during 2008 and $90,000 for services provided during January and February 2009.pre-owned aircraft sale.

Director Independence

Our Board of Directors assesses the independence of our directors and examines the nature and extent of any relationships between General Dynamics and our directors, their families and their affiliates. For a director to be considered independent, the Board must determine that a director does not have any direct or indirect material relationship with General Dynamics. Our Board has established director independence guidelines (the Director Independence Guidelines) as part of the Corporate Governance Guidelines to assist in determining director independence in accordance with the rules of the New York Stock Exchange. The Director Independence Guidelines provide that an “independent director”:

| (1) | is not an employee, nor has an immediate family member who is an executive officer, of General Dynamics; |

| (2) | does not receive, nor has an immediate family member who receives, any direct compensation from General Dynamics, other than director and committee fees; |

| (3) | does not receive, directly or indirectly, any consulting, advisory or other compensatory fee from General Dynamics, other than director and committee fees; |

| (4) | is not, nor has an immediate family member who is, employed as an executive officer of another company where any executive officer of General Dynamics serves on that company’s compensation committee; |

| (5) | is not |

| (6) | does not have an immediate family member who is a current partner of, or an employee assigned to work personally on General Dynamics’ audit by, a present internal or external auditor of General Dynamics; |

| (7) | except as otherwise provided in |

| is not a director, trustee or executive officer of a charitable organization that, in any single fiscal year, receives contributions from General Dynamics in an amount that exceeds the greater of $1 million or 2 percent of the revenues of that organization. |

For purposes of the Director Independence Guidelines, references to General Dynamics include any of our subsidiaries and the term “immediate family member” includes a person’s spouse, parents, children, siblings, mothers- and fathers-in-law, sons- and daughters-in-law, brothers- and sisters-in-law, and anyone (other than domestic employees) who shares the person’s home.

OurIn March 2011, the Board of Directors affirmatively determined that, other than our Chairman and Chief Executive Officer, Nicholas D. Chabraja, and our Vice Chairman, Jay L. Johnson,considered whether each member of the directors currently serving onBoard meets the Board and each nominee to the Board qualifies asdefinition of an “independent director” in accordance with the rules of the New York Stock Exchange and the Director Independence Guidelines. The Board determined that Mary T. Barra, James S. Crown, William P. Fricks, George A. Joulwan, Paul G. Kaminski, John M. Keane, Lester L. Lyles, William A. Osborn and Robert Walmsley each qualifies as an independent director. The Board also determined that Nicholas D. Chabraja and Jay L. Johnson are not independent directors due to Mr. Chabraja’s recent service as chief executive officer and Mr. Johnson’s current service as chief executive officer. To make this determination,these independence determinations, the Board reviewed all relationships between General Dynamics and the directors and affirmatively determined that none of the directors who qualifies as independent has a material business, financial or other type of relationship with General Dynamics (other

(other than as a director or shareholder of the company). Specifically, the Board considered the following relationships and found them to be immaterial:immaterial for the reasons discussed below:

Ms. Barra and Messrs. Crown, Goodman, Joulwan, Kaminski, Keane, Lyles Mundy and ReyesOsborn serve as members of the boards of charitable and other non-profit organizations to which we haveGeneral Dynamics has made payments or contributions in the usual course of our business and annual giving programs. Ms. Lucas is an employeeAll payments or contributions by General Dynamics were below the greater of a university to which we made payments in connection with our employee educational assistance program.$1 million or 2 percent of the organizations’ gross revenues.

Messrs. Crown, Joulwan, Kaminski, Keane, Lyles, Mundy, ReyesOsborn and Walmsley serve as directors of companies, and Mr. Walmsley serves as a consultant to companies and Ms. Barra is an executive officer of a company, to which we sell products and services, or from which we purchase products and services, in the ordinary course of business. None of the directors had any material interest in, or received any special compensation in connection with, these ordinary-course business relationships.

Board Leadership Structure

Our Board elects a chairman from among the directors and determines whether to separate or combine the roles of chairman and chief executive officer based on what it believes best serves the needs of the company and its shareholders at any particular time. In July 2009, the Board separated the roles to facilitate the seamless transition of the chief executive officer position from Mr. Chabraja to Mr. Johnson. In May 2010, the Board determined that it was in the best interests of the company and its shareholders to recombine the roles of chairman and chief executive officer, at which point Mr. Johnson began serving as the chairman and chief executive officer. The Board believes that Mr. Johnson’s in-depth knowledge and keen understanding of the company’s operations and risk management practices position him to provide strong and effective leadership to the Board and to ensure that the Board is informed of important issues facing the company. The Board also believes that having a combined role promotes a cohesive, strong and consistent vision and strategy for the company.

In February 2010 the Board created the position of a lead director. The lead director will be selected annually by the Board from among the independent directors. Mr. Crown was selected as lead director effective May 2010. The Board believes that the lead director position provides additional independent oversight of senior management and Mr. Goodman indirectly own less than 5 percentboard matters. The selection of a companylead director is meant to facilitate, and not to inhibit, communication among the directors or between any of them and the chairman. Accordingly, directors are encouraged to continue to communicate among themselves and directly with the chairman.

The lead director’s authority and responsibilities are as follows:

| (1) | acts as chair at board meetings when the chairman is not present, including meetings of the non-management directors; |

| (2) | has the authority to call meetings of the non-management directors; |

| (3) | coordinates activities of the non-management directors and serves as a liaison between the chairman and the non-management directors; |

| (4) | works with the chairman to develop and agree to meeting schedules and agendas, and agree to the nature of the information that will be provided to directors in advance of meetings; |

| (5) | is available for consultation and communication with significant shareholders, when appropriate; and |

| (6) | performs such other duties as the Board may determine from time to time. |

Risk Oversight

We believe the Board leadership structure described above supports a risk-management process in which senior management is responsible for our company’s day-to-day risk-management processes and the Board provides oversight of those processes. To fulfill this responsibility, the Board oversees risk management at both the full Board and committee levels.

The full Board reviews and approves annually a corporate policy addressing the delegation of authority and assignment of responsibility to ensure that conducts businessthe responsibilities and authority delegated to senior management are appropriate from an operational and risk-management perspective. In addition, the Board assesses the company’s strategic and operational risks throughout the year, with one of our subsidiariesparticular focus on these risks at an annual three-day Board meeting in early February. At this meeting, senior management reports on the opportunities and risks faced by the company in the ordinary coursemarkets in which the company conducts business. Additionally, each business unit president and each business group executive vice president presents the unit’s and group’s respective operating plan and strategic initiatives for the year. The Board reviews, adjusts where appropriate, and approves the business unit and business group goals and adopts our company operating plan for the year. These plans and related risks are then monitored throughout the year as part of business.periodic financial and performance reports given to the Board by the chief financial officer and executive vice presidents of each business group.

In addition, the Audit Committee has responsibility for oversight of the company’s policies and practices concerning risk assessment and risk management. The committee reviews and takes appropriate action with respect to the company’s annual and quarterly financial statements, the internal audit program, the ethics program and disclosures made with respect to the company’s internal controls. To facilitate these risk oversight responsibilities, the committee receives regular briefings from members of senior management on the internal audit plan; Sarbanes-Oxley 404 compliance; significant litigation; ethics program matters; and health, safety and environmental matters. The committee also holds regular executive sessions with the staff vice president, internal audit, and an executive session with the partners of the KPMG LLP audit team.

In addition to the Audit Committee’s role in risk oversight, each of the other Board committees considers risk as it relates to its particular areas of responsibility. The Finance and Benefit Plans Committee oversees the management of the company’s finance policies and the assets of the company’s employee benefit plans. To assess risks in these areas, the committee receives regular briefings from our vice president and treasurer, and chief financial officer, on finance policies and asset performance. The Compensation Committee oversees and administers our incentive and equity compensation programs to ensure that the programs create incentives for strong operational performance and for the long-term benefit of the company and its shareholders. The committee receives regular briefings from the chairman and chief executive officer and the senior vice president, human resources and administration, on compensation matters. Finally, the Nominating and Corporate Governance Committee oversees risks related to board composition and governance matters and receives regular briefings from the senior vice president, general counsel and secretary.

Board Meetings and Attendance

During 2008,2010, the Board of Directors held 10nine meetings. This included a three-day meeting in February to review our 20082010 operating plan, including the operating plan of each of our business units and business groups. TheIn April 2010, the Board held its October meeting atvisited the Basel, Switzerland facility of our Gulfstream business unit. This meeting included visits to Gulfstream’s productJet Aviation subsidiary and services facilities and meetingsmet with Gulfstream executives and employees.Jet Aviation’s management. Each of our directors attended at least 7590 percent

of the meetings of the Board and committees on which they served in 2008.2010. We encourage directors to attend each meeting of shareholders. All of our directors at the time attended the 20082010 annual meeting of shareholders.

Executive Sessions of the Board

Our Board holds executive sessions of the non-management directors in conjunction with all regularly scheduled Board meetings. In addition, theThe non-management directors may also meet without management present at other times as desired by any non-management director. In addition, the independent directors meet in executive session at least once a year. The chairs oflead director serves as chair at the five standing committees rotate as presiding director at these executive sessions.

Board Committees

The Board of Directors has fivefour standing committees, described below. Currently, allthree of the four Board committees are composed of independent, non-management directors, including those committees that are required by the rules of the New York Stock Exchange to be composed solely of independent directors. Each of thesethe Board committees has a written charter. Copies of these charters are available on our website atwww.generaldynamics.com, under the “Investor Relations – Corporate Governance” captions, or in print upon request.

Committee Members. Listed below are the members of each of the fivefour standing committees as of March 9, 2009,7, 2011, with the chair appearing first.

Audit |

| Compensation | Finance and Benefit Plans | Nominating and |

| |||||

William P. Fricks James S. Crown

Lester L. Lyles William A. Osborn Robert Walmsley |

| George A. Joulwan James S. Crown William P. Fricks

| Paul G. Kaminski Nicholas D. Chabraja John M. Keane William A. Osborn | James S. Crown George A. Joulwan John M. Keane

|

Lester L. Lyles

|

Audit Committee.This committee provides oversight on accounting, financial reporting, internal control, auditing and regulatory compliance activities. It selects and evaluates our independent auditors and evaluates their independence. In addition, this committee reviews our audited consolidated financial statements with management and the independent auditors, recommends to the Board whether the audited consolidated financial statements should be included in our annual report on Form 10-K and prepares a report to shareholders that is included in our proxy statement. This committee also evaluates the performance, responsibilities, budget and staffing of the internal audit function, as well as the scope of the internal audit plan. This committee held 11 meetings in 2008.2010. The Board of Directors has determined that Mr. Fricks, the chair of the Audit Committee, isand Mr. Osborn each qualifies as an “audit committee financial expert” as defined by the Securities and Exchange Commission.

Benefit Plans and Investment Committee. This committee reviews and monitors the investment, safekeeping and performance of the assets of our employee benefit plans (other than multiemployer plans). This committee held four meetings in 2008.SEC.

Compensation Committee. This committee evaluates the performance of the chief executive officer and other officers and reviews and approves their compensation. The processes and procedures for the review and approval of executive compensation are described in the Compensation Discussion and Analysis section of this Proxy Statement. In addition, this committee has responsibility for recommending to the Board the level and form of compensation and benefits for directors. It also administers our incentive compensation plans and reviews and monitors succession plans for the chief executive officer and the other officers. This committee held fourfive meetings in 2008.2010.

Consistent with its obligations and responsibilities, the Compensation Committee may form subcommittees of one or more members of the committee and delegate its authority to the subcommittees as it deems appropriate. In addition, the committee has the authority to retain and terminate external advisors in connection with the discharge of its duties. In 2008,The committee’s charter also provides that the committee has sole authority to approve consultant fees (to be funded by the company) and the terms of the consultant’s retention. Pursuant to the charter, the Compensation Committee has, from time to time, engaged PricewaterhouseCoopers LLP (PwC) as a compensation consultant to provide advice on regulatoryexecutive compensation matters. In 2010, the committee, after reviewing fees paid by the company to PwC for other services and considering PwC’s independence generally, engaged PwC to provide context on the current executive compensation landscape from the perspective of regulators, shareholders and the competitive market, trends relatedand to conduct a review of our executive compensation processes. PwC is also available to provide advice to the chairman of the Compensation Committee or the Compensation Committee as a whole on executive compensation matters on an as-needed basis. PwC does not, however, regularly attend Compensation Committee meetings or make any specific recommendations on the amount or form of compensation for any of our executives.

In 2010, the chairman of the Compensation Committee approved fees of approximately $17,000 to PwC in its capacity as external advisor to the Compensation Committee. Management neither made, nor recommended, the decision to engage PwC. The PwC group providing compensation services to the Compensation Committee reports directly to the chairman of the Compensation Committee, and is not involved in providing any other services to the company. During 2010, we also retained PwC to provide services to the company unrelated to executive compensation.

Finance and Benefit Plans Committee. This committee oversees the management of the finance policies of General Dynamics and the assets of our employee benefit plans (other than multiemployer plans). This committee held three meetings in 2010.

Nominating and Corporate Governance Committee. This committee evaluates Boardboard and management effectiveness; advises the Board on corporate governance matters; monitors developments, trends and best practices in corporate governance; and recommends corporate governance guidelines that comply with legal and regulatory requirements. It also identifies qualified individuals to serve as directors and recommends the director nominees proposed either for election at the annual meeting of shareholders or to fill vacancies and newly created directorships between annual meetings. This committee held foursix meetings in 2008.2010.

Director Nominations. Nominations

The Nominating and Corporate Governance Committee identifiesconsiders director nominees from various sources. The committee considers and makes recommendations to the Board concerning the appropriate size and composition of the Board, including the relevant characteristics and experience required of new members. Nominees are chosen with the primary goal of ensuring that the entire Board collectively serves the interests of shareholders based on the attributes, experience, qualifications and skills noted below. In assessing potential nominees,director candidates, the committeeNominating and Corporate Governance Committee considers the character, background and professional experience of candidates. All director nominees should possess good judgmentthe candidates in the context of the current Board composition to ensure there is a diverse range of backgrounds, talent, skill and an inquiringexpertise among the directors. Relevant criteria considered by the committee include: business and independent mind. Prior government service orfinancial expertise, technical expertise and familiarity with the issues affecting defenseaerospace and aerospace businesses are among the relevant criteria.defense

businesses. The committee also carefully considers any potential conflicts of interest. All director nominees must havepossess good judgment, an inquiring and independent mind, and a reputation for the highest personal and professional ethics, integrity and integrity. Theyvalues. Nominees must be willing to devote sufficient time and effort to carrying out their duties and responsibilities effectively and should be committed to servingserve on the Board for an extended period.period of time.

Each year the directors undertake a self-assessment that elicits feedback on the performance and effectiveness of the Board and each committee. As part of this self-assessment, the directors are asked to consider whether, among other things, the current directors possess the appropriate mix of skills, experience and diverse viewpoints to enable the Board to function effectively. The committee carefully considers any potential conflictsresults of interest.the self-assessment are presented to the Nominating and Corporate Governance Committee and the full Board.

The Nominating and Corporate Governance Committee will consider director nominees recommended by shareholders. To recommend a qualified person to serve on the Board of Directors, a shareholder should write to the Corporate Secretary, General Dynamics Corporation, 2941 Fairview Park Drive, Suite 100, Falls Church, Virginia 22042. The written recommendation must contain (1) all information for each director nominee required to be disclosed in a proxy statement by the Securities Exchange Act of 1934, as amended (the Exchange Act); (2) the name and address of the shareholder making the recommendation, and the number of shares owned and the length of ownership; (3) a statement as to whether the director nominee meets the criteria for independence under the rules of the New York Stock Exchange and the Director Independence Guidelines; (4) a description of all arrangements or understandings, and the relationship, between the shareholder and the director nominee, as well as any similar arrangement, understanding or relationship between the director nominee or the shareholder and General Dynamics; and (5) the written consent of each director nominee to serve as a director if elected. The committee will consider and evaluate persons recommended by shareholders in the same manner as it considers and evaluates potential directors identified by the company.

Planning and Business Development Committee. This committee reviews and assesses our business plans and business development activities, including major new program initiatives, enabling technology, and international and government relations activities. This committee held four meetings in 2008.

Communications with the Board

Any shareholder or other interested party who has a concern or question about the conduct of General Dynamics may communicate directly with our non-management directors or the full Board. Communications may be confidential or anonymous. Communications should be submitted in writing to the chair of the Nominating and Corporate Governance Committee in care of the Corporate Secretary, General Dynamics Corporation, 2941 Fairview Park Drive, Suite 100, Falls Church, Virginia 22042. The Corporate Secretary will receive and process all written communications and will refer all substantive communications to the chair of the Nominating and Corporate Governance Committee in accordance with guidelines approved by the independent members of the Board. The chair of the Nominating and Corporate Governance Committee will review and, if necessary, investigate and address all such communications and will report the status of these communications to the non-management directors as a group or the full Board on a quarterly basis.

Our employees and other interested parties may also communicate concerns or complaints about our accounting, internal control over financial reporting or auditing matters directly to the Audit Committee. Communications may be confidential or anonymous and can be submitted in writing or reported by telephone. Written communications should be submitted to the chair of the Audit Committee in care of our ethics officer at the address in the preceding paragraph. Our employees can call a toll-free hotlinehelpline number provided to all employees. The ethics officer will review, investigate and address any concerns or complaints unless the Audit Committee instructs otherwise. The ethics officer will report the status of all concerns and complaints to the Audit Committee. The Audit

Committee may also direct that matters be presented to the full Board and may direct special treatment of any concern or complaint addressed to it, including the retention of outside advisors or counsel.

Director Orientation and Continuing Education

The general counsel and the chief financial officer of the company provide an orientation for new directors and periodically provide materials and briefing sessions for all directors on subjects that assist them in discharging their duties. Within six months of election to the Board, each new director receives a series of briefings in person on our operating plans; significant financial, accounting and risk-management matters; and key policies and practices. At this orientation, a new director also receives briefings on the responsibilities, duties and activities of the committees on which the director will serve. Annually, the Board holds a three-day meeting with our senior management to review and approve the operating plan of each of our business units and business groups and the company as a whole. In addition, directors visit our business units regularly. These visits allow the directors to interact with a broader group of our executives and employees and gain a firsthand view of our operations. All directors are also encouraged to attend director continuing education programs sponsored by educational and other institutions.

Director Compensation

We compensate each non-management director for service on the Board of Directors. We ceased compensating Mr. Johnson for his service on the Board when he became an executive officer of General Dynamics in September 2008. The Compensation Committee reviews director compensation on an annual basis. In early 2008,2010, at the request of the committee, wemanagement reviewed director compensation at peer companies. In support of this review, management engaged Meridian Compensation Partners, LLC (Meridian), a company that spun off from Hewitt Associates (Hewitt)in 2010, to conduct a director compensation survey that included cash retainers, meeting fees, equity compensation and additional director benefits. HewittMeridian provided director compensation data for two peer groups. The first group consisted of the following companies with substantial aerospace or defense revenues:

The Boeing Company | Northrop Grumman Corporation | |

Goodrich Corporation | Raytheon Company | |

Honeywell International Inc. | Rockwell Collins, Inc. | |

L-3 Communications Holdings, Inc. | Textron Inc. | |

Lockheed Martin Corporation | United Technologies Corporation |

To assist the Compensation Committee in various industriesunderstanding director compensation practices and trends in the secondbroader industrial base, management also requested director compensation data from Meridian for a larger group consisted of ninecompanies comprising the 10 companies listed above and 13 additional companies. The companies in the aerospace and defense industry. larger group were:

3M Company | Johnson Controls, Inc. | |

The Boeing Company | L-3 Communications Holdings, Inc. | |

Caterpillar, Inc. | Lockheed Martin Corporation | |

Deere & Company | Northrop Grumman Corporation | |

The Dow Chemical Company | Oshkosh Corporation | |

Emerson Electric Co. | Raytheon Company | |

Goodrich Corporation | Rockwell Collins, Inc. | |

Honeywell International Inc. | SAIC, Inc. | |

Illinois Tool Works Inc. | Textron Inc. | |

International Business Machines Corp. | Tyco International Ltd. | |

International Paper Company | United Technologies Corporation | |

ITT Corporation |

In each group, the average sales of the group approximated our sales. The committee benchmarked director compensation against these two peer groups. BasedThe Compensation Committee reviewed the survey data provided to management by Meridian and, based on this review, recommended an increase in the annual retainer. Based upon the recommendation of the committee, recommended, and the Board subsequently approved changesat its February 2010 meeting an increase in the annual equity award to $122,000. All other elements of director compensation in March 2008.

Director compensation for January 2008 to March 20082010 included the following:

Annual Retainer | $ | |

Lead Director Additional Retainer | $25,000 | |

Committee Chair Additional Annual Retainer | $10,000 | |

Attendance Fees | $2,500 for each meeting of the Board of Directors; $2,000 for each meeting of any committee; and $2,500 per day for attending strategic or financial planning meetings sponsored by General Dynamics | |

Annual Equity Award | Approximately | |

Director compensation for March 2008 to March 2009 included the following:

| ||

| ||

| ||

| ||

In early 2009,2011, as part of its annual review of director compensation, the committee requested that Hewittmanagement update its director compensation analysis. Hewitt provided information on director compensation practices atManagement engaged Meridian to provide survey data for the same peer groups mentionedlisted above. The Compensation Committeecommittee reviewed the analysissurvey data provided by HewittMeridian and, based on this review, recommended ana $5,000 increase in the annual retainer.retainer and a $500 increase in attendance fees for Board meetings. Based upon the recommendation of the committee, the Board approved these changes at its February 2009 meeting an increase in the annual retainer to $65,000.2011 meeting. All other elements of director compensation were unchanged.are unchanged for 2011.

Non-management directors have the option of receiving all or part of their annual retainers in the form of Common Stock. The annual retainer, additional committee chair retainer (if any), and attendance fees paid to each director during 20082010 are reflected in the aggregate in the Fees Earned or Paid in Cash column of the Director Compensation for Fiscal Year 20082010 table, irrespective of whether a director took the annual retainer in shares of Common Stock. The annual equity award consists of a restricted stock award valued at approximately one-third of the total equity award and a stock option award valued at approximately two-thirds of the total equity award.

We began compensating Mr. Chabraja for his service on the Board after he retired as chief executive officer on June 30, 2009. At that time, Mr. Chabraja began receiving the compensation listed above as a non-management director. In addition, for his service as non-executive chairman from June 2009 until May 2010 Mr. Chabraja received an annual retainer of $750,000. In determining Mr. Chabraja’s retainer, the Compensation Committee requested information from management regarding retainer compensation amounts paid to non-executive chairs. Management obtained survey data from Hewitt Associates for companies that publicly disclosed compensation amounts for non-executive chairs, which resulted in the following companies:

The AES Corporation | Marathon Oil Corporation | |

The AllState Corporation | McDonald’s Corporation | |

American International Group, Inc. | Murphy Oil Corporation | |

AmerisourceBergen Corporation | ONEOK, Inc. | |

The Bank of New York Mellon Corporation | The Pepsi Bottling Group, Inc. | |

Bristol-Myers Squibb Company | The Progressive Corporation | |

Cardinal Health, Inc. | Publix Super Markets, Inc. | |

CBS Corporation | Rite Aid Corporation | |

CHS Inc. | Sun Microsystems, Inc. | |

Coca-Cola Enterprises Inc. | The TJX Companies, Inc. | |

Costco Wholesale Corporation | Tech Data Corporation | |

Federal National Mortgage Association | Texas Instruments Incorporated | |

Freeport-McMoran Copper & Gold Inc. | Time Warner Inc. | |

Health Net, Inc. | Tyson Foods, Inc. | |

Humana Inc. | UnitedHealth Group Incorporated | |

Ingram Micro Inc. | Viacom Inc. | |

Intel Corporation | The Walt Disney Company | |

L-3 Communications Holdings, Inc. | Waste Management, Inc. | |

Loews Corporation |

In connection with the creation of a Lead Director position by the Board in February 2010, the committee asked management to provide information regarding amounts paid to lead directors. Management provided information for companies in the Fortune 200 with lead directors. Based upon this information, the committee established a $25,000 lead director additional retainer, which represented the median of the comparative data.

In light of the travel required by service on the Board, General Dynamicswe also providesprovide each director with accidental death and dismemberment insurance coverage. Payments by General Dynamics for director accidental death and dismemberment insurance premiums are reflected in the All Other Compensation column of the Director Compensation for Fiscal Year 20082010 table.

Director Stock Ownership Guidelines

The Board of Directors believes that each director should develop a meaningful ownership position in General Dynamics. Therefore, the Board of Directors adopted stock ownership guidelines for non-management directors. Pursuant to these guidelines, each non-management director is expected to own at least 4,000 shares of our Common Stock. Non-management directors are expected to achieve the target ownership threshold within five years of election to the Board. Management directors are subject to the ownership requirements discussed on page 23 of this Proxy Statement under “Compensation Discussion and Analysis – Stock Ownership Guidelines.”

Director Compensation Table

The table below provides total compensation for the last completed fiscal year for each of General Dynamics’ non-management directors. In September 2008, Mr. Johnson became an executive officer ofdirectors serving during the company and ceased receiving compensation for his services as a director.year. The number of shares of restricted stock and the number of shares subject to options awarded to the directors annually are the same for each director. Differences in restricted stock award values and option award values reflected in the table are due to variances in the amortization periods used to calculate the Statement of Financial Accounting Standards No. 123(R),Share-Based Payment (FAS 123(R)), restricted stock expense and the length of service of a director.

Director Compensation for Fiscal Year 20082010

| Name | Fees Earned or Paid in Cash (a) | Stock Awards (b) | Option Awards (c) | All Other Compensation (d) | Total | Fees Earned or Paid in Cash(a) | Stock Awards (b) | Option Awards (c) | All Other Compensation (d) | Total | |||||||||||||||||||||||||

Nicholas D. Chabraja | $ | 473,500 | $ | 40,420 | $ | 81,258 | $ | 2,140 | $ | 597,318 | |||||||||||||||||||||||||

James S. Crown | $ | 129,750 | $ | 47,930 | $ | 69,829 | $ | 2,164 | $ | 249,673 | $ | 163,167 | $ | 40,420 | $ | 81,258 | $ | 2,140 | $ | 286,985 | |||||||||||||||

William P. Fricks | $ | 131,750 | $ | 36,382 | $ | 69,829 | $ | 2,164 | $ | 240,125 | $ | 134,500 | $ | 40,420 | $ | 81,258 | $ | 2,140 | $ | 258,318 | |||||||||||||||

Charles H. Goodman | $ | 105,083 | $ | 36,382 | $ | 69,829 | $ | 5,517 | $ | 216,811 | |||||||||||||||||||||||||

Jay L. Johnson | $ | 73,917 | $ | 36,382 | $ | 69,829 | $ | 2,164 | $ | 182,292 | |||||||||||||||||||||||||

George A. Joulwan | $ | 113,750 | $ | 36,382 | $ | 69,829 | $ | 3,114 | $ | 223,075 | $ | 124,500 | $ | 40,420 | $ | 81,258 | $ | 4,080 | $ | 250,258 | |||||||||||||||

Paul G. Kaminski | $ | 109,750 | $ | 36,382 | $ | 69,829 | $ | 2,164 | $ | 218,125 | $ | 118,500 | $ | 40,420 | $ | 81,258 | $ | 2,140 | $ | 242,318 | |||||||||||||||

John M. Keane | $ | 105,250 | $ | 36,382 | $ | 69,829 | $ | 2,164 | $ | 213,625 | $ | 108,500 | $ | 40,420 | $ | 81,258 | $ | 2,140 | $ | 232,318 | |||||||||||||||

Deborah J. Lucas | $ | 120,417 | $ | 26,609 | $ | 69,829 | $ | 2,164 | $ | 219,019 | |||||||||||||||||||||||||

Lester L. Lyles | $ | 117,250 | $ | 36,382 | $ | 69,829 | $ | 2,164 | $ | 225,625 | $ | 122,000 | $ | 40,420 | $ | 81,258 | $ | 2,140 | $ | 245,818 | |||||||||||||||

Carl E. Mundy, Jr. | $ | 105,750 | $ | 36,382 | $ | 69,829 | $ | 4,107 | $ | 216,068 | |||||||||||||||||||||||||

J. Christopher Reyes | $ | 91,250 | $ | 19,039 | $ | 31,240 | $ | 2,164 | $ | 143,693 | |||||||||||||||||||||||||

William A. Osborn | $ | 120,500 | $ | 40,420 | $ | 81,258 | $ | 2,140 | $ | 244,318 | |||||||||||||||||||||||||

J. Christopher Reyes (e) | $ | 40,167 | $ | 40,420 | $ | 81,258 | $ | 1,070 | $ | 162,915 | |||||||||||||||||||||||||

Robert Walmsley | $ | 101,750 | $ | 36,382 | $ | 69,829 | $ | 3,114 | $ | 211,075 | $ | 124,500 | $ | 40,420 | $ | 81,258 | $ | 4,080 | $ | 250,258 | |||||||||||||||

| (a) | Messrs. Crown, Fricks, |

| (b) | The amounts reported in the Stock Awards column reflect the |

| (c) | The amounts reported in the Option Awards column reflect the |

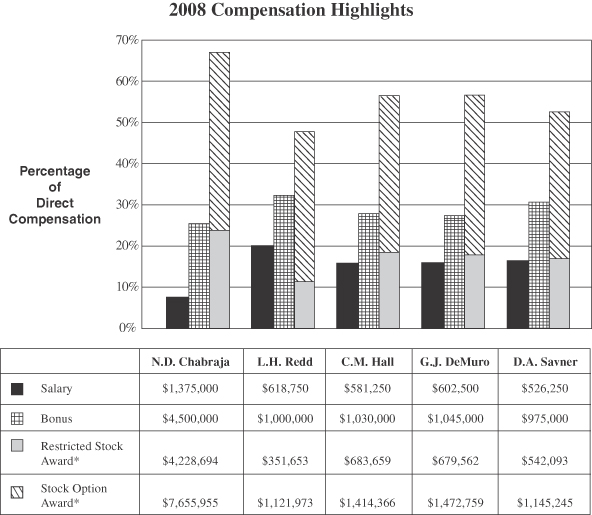

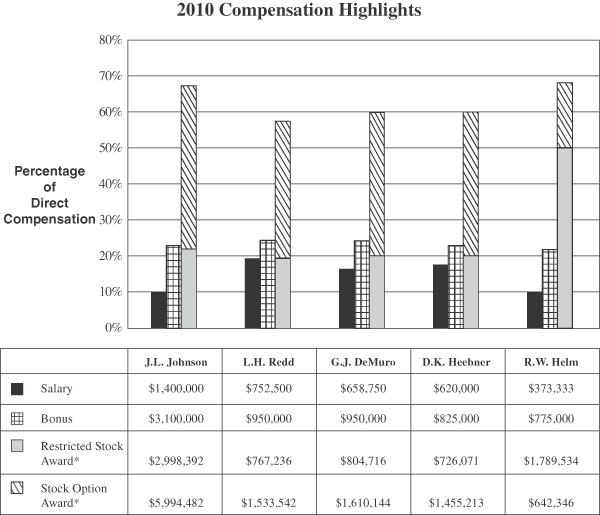

| (d) | Amounts listed reflect payments by General Dynamics for accidental death and dismemberment insurance. |